Gaming and Leisure Properties Gives Investors Higher Dividend

Gaming and Leisure Properties is giving investors higher dividend for Thanksgiving. The company said it is boosting quarterly payout to 70 cents per share. This is almost three percent higher and up from 68 cents, the current rate. Gaming and Leisure properties is a Pennsylvania-based company that owns 43 casinos in 17 states.

The new dividend means that shares of GLP yield 6.61 percent and this is based on $42.35. GLP shares yield more than 10-year Treasuries at a rate of 6.61 percent. The shares yield more than triple and the S&P 500, and more than double the widely followed MSCI US Investable Market Real Estate 25/50 Index.

GLP Steady Dividend Growth

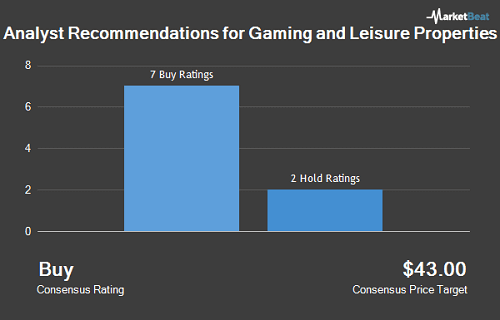

In a bid to get tax benefits, GLP and REITs always pay out 90 percent of their earnings in the form of dividends to its clients. Founded in 2013, this quarterly dividend is in its sixth edition since the company was established and aims to pay regular quarterly dividends. Shareholders can expect to get their dividends on 27 December. In 2019, the gaming real estate gained 31% in shares. Deciding whether to invest in GLPI is a little tricky, the company presents both negative and positive signals. According to analysts from Wall Street, GLPI’s performance has shown a mixture of weaknesses and strengths. Although the investment might be risky, it also presents huge potential for ROI. The company’s stock price has ranges from 31.19 to 43.12.

Who is Gaming and Leisure Properties (GLPI)?

Gaming and Leisure Properties (GLPI) has created a move of 0.38% at the closed at $42.43. With a market cap of $9.18B. Some may consider GLPI as the first gaming-related REIT. The company continues to new acquisitions to grow its portfolio. CEO of GLPI, Peter M. Carlino says the company will continue to benefit from improving valuation. He says the company continued to strengthen its balance sheet through an opportunistic refinancing in the quarter three.